Which of the following statements always apply to corporations? This question delves into the fundamental characteristics and legal framework that define corporations, providing insights into their distinct features and operations.

Corporations, as legal entities separate from their owners, enjoy limited liability, shareholder ownership, and a profit-driven motive. These attributes shape their decision-making, governance, and impact on society.

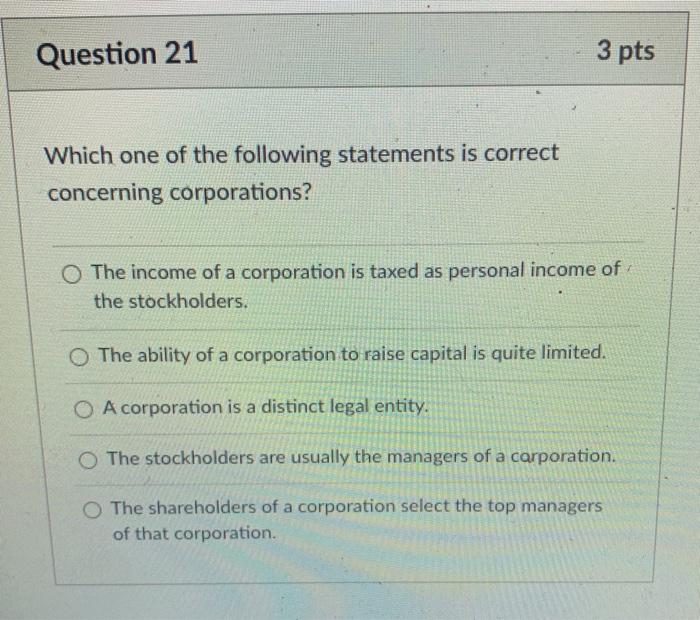

1. Legal Entities: Which Of The Following Statements Always Apply To Corporations

Corporations are distinct legal entities separate from their owners, known as shareholders. This separation provides several advantages.

One benefit is the protection of shareholders from personal liability for corporate debts and obligations. Shareholders are only liable for the amount of their investment in the corporation, limiting their financial risk.

2. Shareholder Ownership

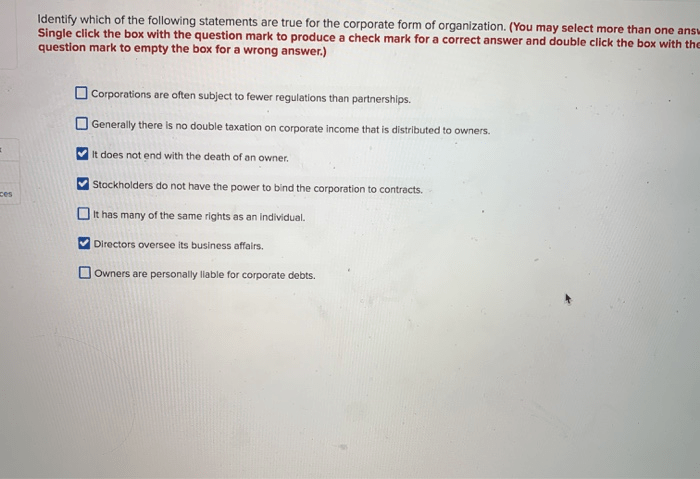

Shareholders are the owners of a corporation and have certain rights and responsibilities.

Shareholders elect a board of directors, which oversees the management of the corporation and makes major decisions on behalf of the shareholders.

3. Board of Directors

The board of directors is responsible for:

- Setting corporate strategy

- Overseeing the performance of management

- Ensuring compliance with legal and regulatory requirements

4. Profit Motive

The primary objective of corporations is to generate profits for their shareholders.

This profit motive influences corporate decisions, such as the allocation of resources, pricing strategies, and investment decisions.

5. Limited Liability

Limited liability protects shareholders from being held personally responsible for corporate debts and liabilities.

This means that shareholders cannot lose more than the amount they have invested in the corporation.

6. Taxation

Corporations are subject to unique tax treatment compared to other business structures.

Corporations pay taxes on their profits, and shareholders pay taxes on dividends they receive from the corporation.

7. Corporate Governance

Corporate governance refers to the principles and practices that ensure transparency, accountability, and ethical behavior in corporations.

Good corporate governance promotes shareholder confidence and protects the interests of all stakeholders.

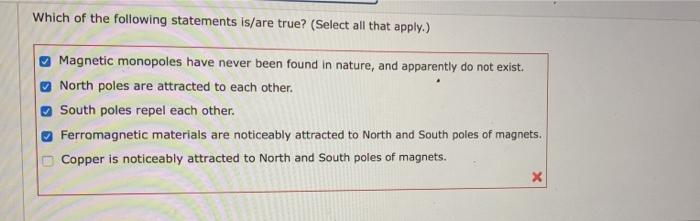

8. Regulatory Environment

Corporations operate within a regulatory environment that governs their activities.

Government regulations aim to protect consumers, investors, and the environment, and impact corporate decision-making and operations.

9. Social Responsibility

Corporate social responsibility (CSR) refers to the obligation of corporations to contribute to social and environmental well-being.

CSR initiatives can include environmental sustainability, community engagement, and philanthropic activities.

10. Types of Corporations

| Type of Corporation | Characteristics | Advantages | |

|---|---|---|---|

| C Corporation | – Most common type | – Limited liability | – Double taxation |

| S Corporation | – Limited liability | – Pass-through taxation | – Limited to 100 shareholders |

| Nonprofit Corporation | – Not-for-profit | – Tax-exempt status | – Limited fundraising ability |

11. Formation and Dissolution

Forming a corporation involves:

- Choosing a corporate name

- Filing articles of incorporation

- Issuing shares of stock

Dissolving a corporation requires:

- Board of directors’ resolution

- Shareholder approval

- Filing dissolution documents with the state

Quick FAQs

What is the primary purpose of a corporation?

The primary purpose of a corporation is to generate profits for its shareholders.

How does limited liability protect shareholders?

Limited liability protects shareholders from personal liability for corporate debts and obligations.

What is the role of the board of directors in a corporation?

The board of directors oversees management, ensures accountability, and represents the interests of shareholders.